Thus for example if a construction company located in san antonio purchases a diesel powered backhoe from a supplier located in houston the construction company must pay tax on this purchase.

Texas sales tax certificate frame.

Texas sales and use tax exemption certification.

01 116 texas sales and use tax return list supplement pdf 01 148 texas sales and use tax return credits and customs broker schedule pdf 01 922 instructions for completing texas sales and use tax return pdf 01 922 s instrucciones para llenar la declaracón de impuestos sobre las ventas y uso pdf 01 118 texas sales and use tax.

3 8 out of 5 stars 13 ratings.

Glued and v nail corners for added durability.

Sales tax versus use tax.

Texas imposes a 6 25 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 8 25 percent.

Sales tax certificate wood frame 8 5 x 3 5 inches black wood.

Texas imposes tax on sales of taxable item.

Solid wood charcoal grey finish 75 inches wide.

4 0 out of 5 stars 15 ratings.

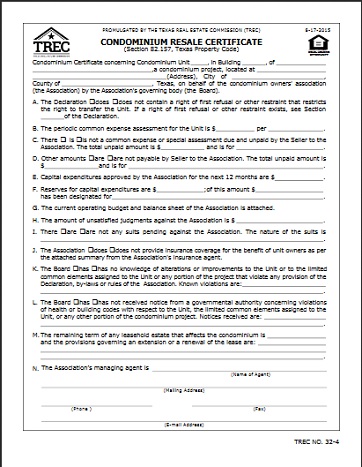

Texas sales and use tax resale certificate.

Glued and v nail corners for added durability.

Solid wood black matte finish 75 inches wide.

Box or route number city state zip code texas sales and use tax permit number must contain 11 digits out of state retailer s registration number or federal taxpayers registry rfc.

Phone area code and number address street number p o.

Select request certificate clearance letter under the franchise tax esystems menu.

Name of purchaser firm or agency as shown on permit.

Sales because the transaction is consummated in texas.

20 95 free shipping.

I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable.

Name of purchaser firm or agency address street number p o.

Sales s in texas.

If the taxpayer for whom you are requesting a certificate letter is not listed add the taxpayer to your assigned account list using their 11 digit taxpayer number and webfile xt number.

Built to display sales tax licenses and certificates measuring 8 5 x 3 5 inches.

Because texas is a member of this agreement buyers can use both the multistate tax commission mtc uniform sales tax certificate and the border states uniform resale certificate bsc when making qualifying.

Box or route number phone area code and number city state zip code.

A taxable item that is purchased for resale is exempt from sales or use tax if the seller accepts a properly completed form 01 339 texas sales and use tax resale certificate pdf instead of collecting the sales tax due the resale certificate is the seller s evidence as to why sales tax was not collected on that transaction and should be retained in the seller s books and records for.

This certificate does not require a number to be valid.

Select a taxpayer from the list.

Built to display sales tax licenses and certificates measuring 8 5 x 3 5 inches.